Quality First Scholarship

(Preschool Only)

This Quality First Scholarship for preschoolers only.

VCA is a 5 Star Quality First Certified Preschool. With this certification comes some scholarship monies that we can offer qualifying preschool students.

What is Quality First?

“Quality First – a signature program of First Things First – partners with regulated early childhood providers to make quality improvements that research proves help children birth to 5 thrive, such as education for teachers to expand their expertise in working with young children. It also supports parents with information about what to look for in quality early childhood programs that goes beyond health and safety to include a nurturing environment that supports their child’s learning.

First Things First is a voter-created, statewide organization that funds early education and health programs to help kids be successful once they enter kindergarten. Decisions about how those funds are spent are made by local councils staffed by community volunteers. To learn more, visit FirstThingsFirst.org.” – www.qualityfirstaz.com

Who qualifies for a Quality First Scholarship?

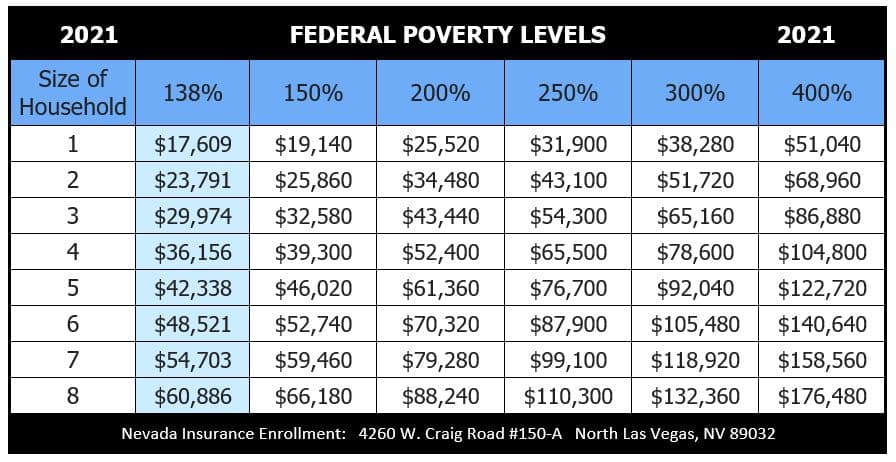

To find out who qualifies for these scholarships, please review the chart below showing federal poverty levels. To qualify for these scholarships you must fall at or below the 200% for your family’s income in one year. The easiest way to see is to go to the 200% column and go down. Look across to match up the number of people in your household. This is the yearly income requirement. If you are at or below that amount you may qualify for a scholarship.

If you do believe you will qualify for a scholarship and would like to apply for one you may print an application from the link below and bring it into the school office, or come by the school office and pick up an application. The application needs to be completely filled out and the following paperwork included with the application.

*copies of the last month pay stubs (for all who are employed)

*a copy of the front form of your taxes to verify the number in the household (You may black out any info except your names and number in the household)

*Copy of your child’s birth certificate

Everything needs to be turned in to the VCA office fully completed to be considered for a scholarship.

Applications are due the June before the school year your child will be attending. Applications will then be reviewed by the VCA Scholarship Committee. We are limited on the number of scholarships that will be given out each school year. Applications will be considered on a first-come, first-serve basis.

Arizona Tax Credit

(Kinder-8th Grade)

Arizona Tax Credit

“A tuition tax credit program established for Arizona taxpayers allowing redirection of their tax dollars to help Arizona’s children have a choice in their education. “ -NACSSF

“Credit for Contributions to School Tuition Organizations

Original Individual Tax Credit

ARIZONA “ORIGINAL” STATE TAX CREDIT

This is a tax credit program available for Arizona taxpayers who have a state tax liability. You can DIRECT your state income tax dollars to a scholarship fund organization. It’s your choice; you can see the benefit of your Arizona Tax Credit Dollars working locally in education or let others decide for you where your tax dollars should be used!

You may make a donation anytime during the current tax year or UNTIL April 15 of the following year. If you make a donation after December 31, you need to indicate which tax year you want your tax credit to apply to: 2019 or 2020; it’s that simple.

You can donate up to $1,138.00 (married filing jointly) or $569.00 (single/head of household) or your tax liability whichever is less

until April 15 for an original Individual tax credit for 2019.

PLUS an additional amounts can be given to the Switcher Tax Credit

Switcher Tax Credit

After donating the full amount allowed under the Original Tax Credit ($1,138 Married Filing Jointly or $569 Single/Head of Household), additional donated amounts may be applied to the SWITCHER Tax Credit or carried over under the Original Tax Credit for up to five years. For the Switcher Tax Credit, up to an additional $1,131 (Married Filing Jointly), or $566 (Single or Head of Household) may be donated.

A total of $2,269.00 (Married) or $1,135.00 (Single) may be donated by combining both

Original and Switcher donations.

Students who are eligible to receive scholarships under the SWITCHER Tax Credit donation include students who:

A. Attended a governmental primary or secondary school or attended a preschool program that offers services to students with disabilities. Students must have attended for at least 90 days of the prior fiscal year and are transferring to a qualified school.

B. Are enrolling in a qualified school in a Kindergarten program.

C. Are the dependent of a member of the Armed Forces of the United States who is stationed in Arizona pursuant to military orders.

D. Received an educational scholarship or tuition grant under one of the above criteria or from the low-income corporate donation program if the child continues to attend a qualified school in a subsequent year.

The first ($1,138 Married Filing Jointly) donated to a School Tuition Organization (or $569 Single or Head of Household) must be claimed as an Original Tax Credit.

No credit can be claimed for the Switcher credit until the maximum credit is claimed for the Original credit.

Tax forms can be downloaded from our “Forms” page to submit with your tax return. Please contact your tax adviser for further information. NACSSF will send an annual receipt.

Click link to read about AZ Tax Credit on AZDOR.GOV

School Tax Credits for Individuals

Who can donate?

“Any Arizona taxpayer, who has a tax liability, may give to support this program by redirection of their tax dollars paid to the state of Arizona.” -NACSSF

Your AZ tax credit donation is a redirection of the money you paid in taxes to the state of Arizona. This donation does not come out of your AZ tax refund. It is a dollar for dollar tax credit, not a deduction.

How do I utilize this tax credit on my taxes?

VCA works with the NACSSF (Northern Arizona Christian School Scholarship Fund)

After you claim the tax credit in your AZ taxes you can make a donation by using any one of the following options:

- Mail a completed NACSSF pamphlet (you can pick a pamphlet at our school office) with your donation to:

NACSSF

P.O Box 3923, Cottonwood, AZ 86326

2. Go to nacssf.org to contribute online

3.Bring your donation and completed NACSSF pamphlet into the school office

How does my Student receive Scholarship money from the Arizona Tax Credit?

There is a place on the NACSSF pamphlet to fill in a recommended student. This is how many students attending VCA receive scholarship money from the NACSSF, along with general donations to the NACSSF scholarship fund.

If you have a student currently enrolled at VCA and would like to find out if they qualify to receive scholarship funds from the NACSSF, please fill out an AZ Tax Credit scholarship application and turn it into the School Office.

Recommending a student-

The parents of a student applying for a scholarship from NACSSF cannot recommend their own child on the NACSSF pamphlet, but grandparents, and all other family members are allowed to recommend the child on their tax credit forms.

“Though recommendations are allowed and considered for both tax credit programs (“original” & “switcher”) each program has a different set of criteria for student qualifications. If you recommend a student, they may only qualify for one of the programs and not the other program. In that case the portion of the donation which the student does not qualify for will go to the aid of another qualified student. “-NACSSF

For more information about the Arizona Tax credit or NACSSF you can call/visit our school office or www.nacssf.org.

Click the Button Below to fill out a NACSSF Student Scholarship Application

ABOUT US

We are a vibrant community who exist for the purpose of assisting families in their God-given call to educate their children. We partner with a variety of families including those who are looking for a strong Christian foundation as well as those who are passionate about finding a safe environment with high expectations and quality academics. Located on the campus of the Verde Community Church we are blessed to have bright spacious classrooms, a full-size gymnasium, and a large playground complete with a plethora of equipment More Info >>

OFFICE HOURS

Daily Office Hours

Monday - Thursday

7:30 am - 4:00 pm

Summer Hours

Monday - Thursday

9:00 am - 3:00 pm